Disclosure: This post contains affiliate links. If you make a purchase through these links, I may earn a commission at no extra cost to you.

Introduction

Have you ever dreamed of earning money while you sleep, travel, or enjoy your hobbies? Sounds too good to be true, right? Well, it’s not. It’s possible with passive income.

Passive income is money that you earn without active involvement or work. It’s different from active income, which is money that you earn by exchanging your time and skills for money. With passive income, you create or invest in something once, and then you get paid over and over again for it.

Passive income can help you achieve financial freedom, diversify your income streams, and create more time and flexibility in your life. It can also reduce your stress and dependence on a single source of income.

But how do you create passive income? What are some examples of passive income sources? And what are the benefits and challenges of passive income? In this blog post, I will answer these questions and more. I will also share with you some tips and resources on how to get started with passive income.

Watch: Introduction to Passive Income: How to Earn Money While You Sleep

If you prefer to Read, continue from here.

Click button for more blog posts about business.

What is Passive Income?

Passive income is money that you earn without active involvement or work. It’s money that you make while you sleep, travel, or do other things that you enjoy.

Passive income does not mean that you don’t have to do any work at all. It means that you do the work upfront, and then you reap the rewards later. For example, if you write a book, you have to spend time and effort to write, edit, and publish it. But once it’s done, you can earn royalties from every sale of the book, without having to write another word.

Passive income also does not mean that you don’t have to maintain or manage your income sources. It means that you have to do minimal or occasional work to keep them running. For example, if you own a rental property, you have to collect rent, pay taxes, and deal with repairs and maintenance. But you don’t have to be there every day or work a fixed number of hours.

Passive income is not a get-rich-quick scheme. It takes time, money, and patience to build and grow. It also requires research, planning, and strategy. You have to find the right passive income sources for your goals, skills, and interests. You also have to monitor and optimize your performance and income.

Why is Passive Income Important?

Passive income is important because it can help you achieve many benefits, such as:

- Financial freedom: Passive income can help you achieve financial freedom, which is the ability to live the life you want without worrying about money.

With passive income, you can cover your living expenses, save for your future, and pursue your passions. You can also have more control over your finances and make better decisions. - Diversified income streams: Passive income can help you diversify your income streams, which is the practice of having multiple sources of income.

With diversified income streams, you can reduce your risk and increase your stability. You can also have more opportunities and options to grow your income and wealth. - More time and flexibility: Passive income can help you create more time and flexibility in your life. With passive income, you can free up your time from active work and use it for other purposes.

You can also have more flexibility to choose when, where, and how you work. You can also have more balance and harmony in your life.

What are Some Examples of Passive Income Sources?

There are many examples of passive income sources, but they can be broadly categorized into two types: creating and investing.

Creating Passive Income

Creating passive income means creating something of value that can generate income for you over time. Some examples of creating passive income are:

- Writing: Writing is one of the most popular and accessible ways to create passive income. You can write books, ebooks, blogs, articles, newsletters, courses, and more.

You can earn money from selling your products, getting paid by advertisers or sponsors, or receiving donations or tips from your audience. - Podcasting: Podcasting is another way to create passive income by sharing your voice and knowledge with the world.

You can create podcasts on any topic that you are passionate or knowledgeable about, such as business, education, entertainment, health, or personal development. You can earn money from selling your products or services, getting paid by advertisers or sponsors, or receiving donations or tips from your listeners. - Video: Video is another way to create passive income by creating and sharing visual content with the world. You can create videos on any topic that you are passionate or knowledgeable about, such as cooking, gaming, travel, or fitness.

You can earn money from selling your products or services, getting paid by advertisers or sponsors, or receiving donations or tips from your viewers. - Software: Software is another way to create passive income by creating and selling digital products or services that can solve problems or add value for your customers.

You can create software such as apps, games, websites, plugins, or tools. You can earn money from selling your software, getting paid by advertisers or sponsors, or receiving donations or tips from your users.

Investing Passive Income

Investing passive income means investing your money in something that can generate income for you over time. Some examples of investing passive income are:

- Dividends: Dividends are payments that you receive from owning shares of a company that distributes its profits to its shareholders.

You can invest in dividend-paying stocks, funds, or ETFs that can provide you with a steady and reliable income stream. You can also reinvest your dividends to compound your returns and grow your wealth. - Interest: Interest is money that you receive from lending your money to someone else who pays you back with interest. You can invest in interest-bearing assets, such as bonds, CDs, or peer-to-peer lending platforms that can provide you with a fixed and predictable income stream.

You can also reinvest your interest to compound your returns and grow your wealth. - Rent: Rent is money that you receive from renting out your property or space to someone else who pays you rent. You can invest in rental properties, such as apartments, houses, or commercial buildings that can provide you with a passive and stable income stream.

You can also leverage your property to increase your cash flow and equity. - Royalties: Royalties are payments that you receive from licensing your intellectual property, such as your music, art, or inventions to someone else who pays you royalties.

You can invest in royalty-generating assets, such as songs, books, patents, or trademarks that can provide you with a passive and recurring income stream. You can also leverage your intellectual property to create more value and income.

How to Get Started with Passive Income?

Getting started with passive income can be challenging, but not impossible. Here are some steps that you can follow to get started with passive income:

- Define your goals: The first step to getting started with passive income is to define your goals.

What are you trying to achieve with passive income? How much passive income do you need or want? How long do you want to achieve it? How much time, money, and effort are you willing to invest?

Having clear and realistic goals can help you stay focused and motivated. - Choose your passive income sources: The next step to getting started with passive income is to choose your passive income sources.

What are the best passive income sources for your goals, skills, and interests? How can you create or invest in them? How can you optimize and scale them?

Choosing the right passive income sources can help you maximize your income and potential. - Take action: The final step to getting started with passive income is to take action.

How can you start creating or investing in your passive income sources? What are the steps that you need to take? What are the challenges that you need to overcome? What are the resources that you need to use?

Taking action can help you turn your ideas into reality and generate passive income.

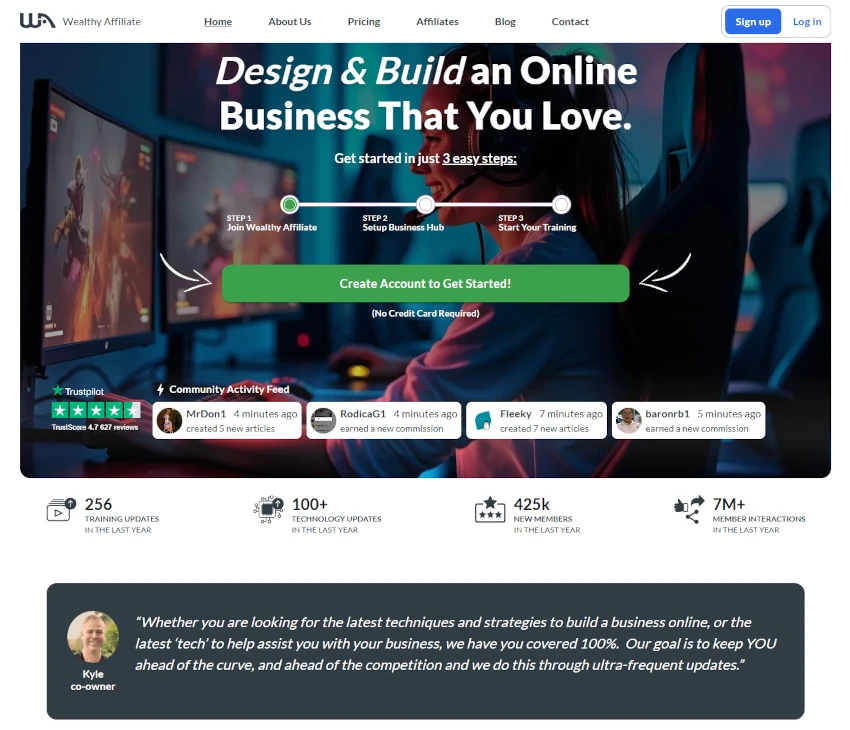

If you are interested in creating passive income with affiliate marketing, I have a special offer for you. You can join Wealthy Affiliate, the best platform for learning and building your own online business with affiliate marketing.

Wealthy Affiliate provides you with step-by-step training, web hosting and tools, live support and a vibrant community of experts and fellow entrepreneurs. You can start for free and get access to a business hub and a website. You can also upgrade to premium and unlock more features and benefits.

Wealthy Affiliate is the ultimate solution for turning your passion into profits.

Launch Your Online Business with Wealthy Affiliate

Get started with the Free Starter Membership, and enjoy these fantastic benefits:

- Free Practice Website: Begin your online business with a ready-to-use website.

- Business Hub: Access step-by-step training to learn and grow your online business.

- Keyword Research Tool: Discover keywords that will get your content found.

- AI Article Designer: Utilize one of the best AI tools for creating high-quality, SEO-optimized content quickly and efficiently.

- Tech Team & Community Support: Receive ongoing support from our tech team and vibrant community.

Ready to start your business and make money? Click on the image below for a link to Wealthy Affiliate and start your free trial today!

Introduction to Passive Income: How to Earn Money While You Sleep

Timotheus Final Thoughts

Passive income is money that you earn without active involvement or work. It can help you achieve financial freedom, diversify your income streams, and create more time and flexibility in your life.

However, passive income is not easy or fast. It takes time, money, and patience to build and grow. It also requires research, planning, and strategy. You have to find the right passive income sources for your goals, skills, and interests. You also have to monitor and optimize your performance and income.

I hope this blog post has given you an introduction to passive income and how to get started with it. If you have any questions or comments, please feel free to leave them below. I would love to hear from you and help you out.

Thank you for reading and happy passive income!

If you have ANY questions, or anything to clarify, please drop a comment below. I will be happy to help you.

I wish everyone good heath, wealth, and success!

Timotheus

AI & Digital Marketing Expert | Lecturer | Amazon Bestselling Author | Cancer Survivor